Automated Trading Services

Automated Trading Services

What we do

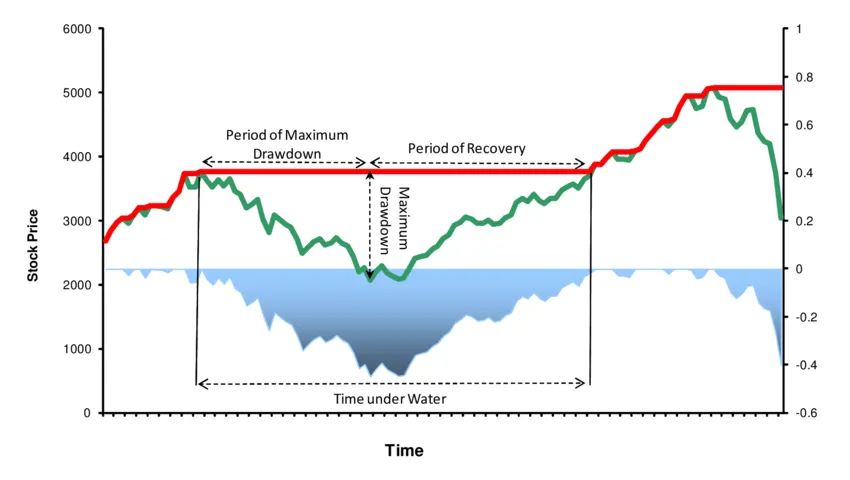

We do Intraday Automated Trading in Nifty & Sensex weekly options. The call/put option pair is sold in the morning after the stock market opens with proper stop loss and based on market movements the adjustments are done. The options are exited and profit/loss is booked before market closing. The trading is fully automated by our python based software. We keep a close watch on our client’s trades during market hours. We only work with Zerodha Broker as we experienced it as the best and most stable broker for automated trading. The drawdown is 5-10 % based on our past experience

Our equipments:

We use Ubuntu (linux based) operating system.

Our servers run continuously with backup power.

We have uninterrupted internet supply using broadbands from two different operators.

What you need to do

Open zerodha demat account if you don’t have it, with our following referral link

Testimonial

Our Clients Reviews

FAQ

Frequently Ask Questions.

Frequently Asked Questions (FAQ) – Automated Trading

Automated trading, also known as algorithmic trading, uses pre-programmed software to execute trades based on predefined criteria. It eliminates the need for manual trading and can react to market conditions in real time.

Automated trading systems use algorithms to analyze market data, identify trading opportunities, and execute trades without human intervention. These systems can follow technical indicators, price movements, and other market conditions to make decisions.

- Removes emotional decision-making

- Executes trades faster than manual trading

- Operates 24/7 without requiring supervision

- Allows for backtesting strategies before live trading

- Can manage multiple trades simultaneously

Profitability depends on the strategy used, market conditions, and risk management. While automation can improve efficiency, no system guarantees profits, and losses are always a possibility.

Not necessarily. Some platforms offer no-code or low-code solutions where users can create trading bots with drag-and-drop interfaces. However, custom strategies may require programming knowledge in languages like Python or MQL4.

Automated trading can be applied to stocks, forex, cryptocurrencies, commodities, and futures markets. The choice depends on the broker and platform you use.